The main objective of DOEN Ventures is to achieve a positive impact on society by supporting new sustainable or socially inclusive entrepreneurs. Impact is central to all our investments. Over the past 25 years, DOEN Ventures has become the biggest impact investor for sustainable and socially inclusive start-ups in the Netherlands. Currently, our portfolio consists of 50 equity investments and convertible loans, and 18 fund investments.

What characterizes our investments:

- A focus on impact

- Early-stage investing and growing alongside start-ups

- We’re not afraid to take risks

DOEN Ventures invests directly in sustainable or socially inclusive startups through convertible loans or equity. Initial investments range from €50,000 to €500,000. We also have the ability to provide follow-on funding. In cases where DOEN Ventures does not have sufficient expertise in the local context abroad, or in niche sectors within the Netherlands, we choose to invest via an investment fund.

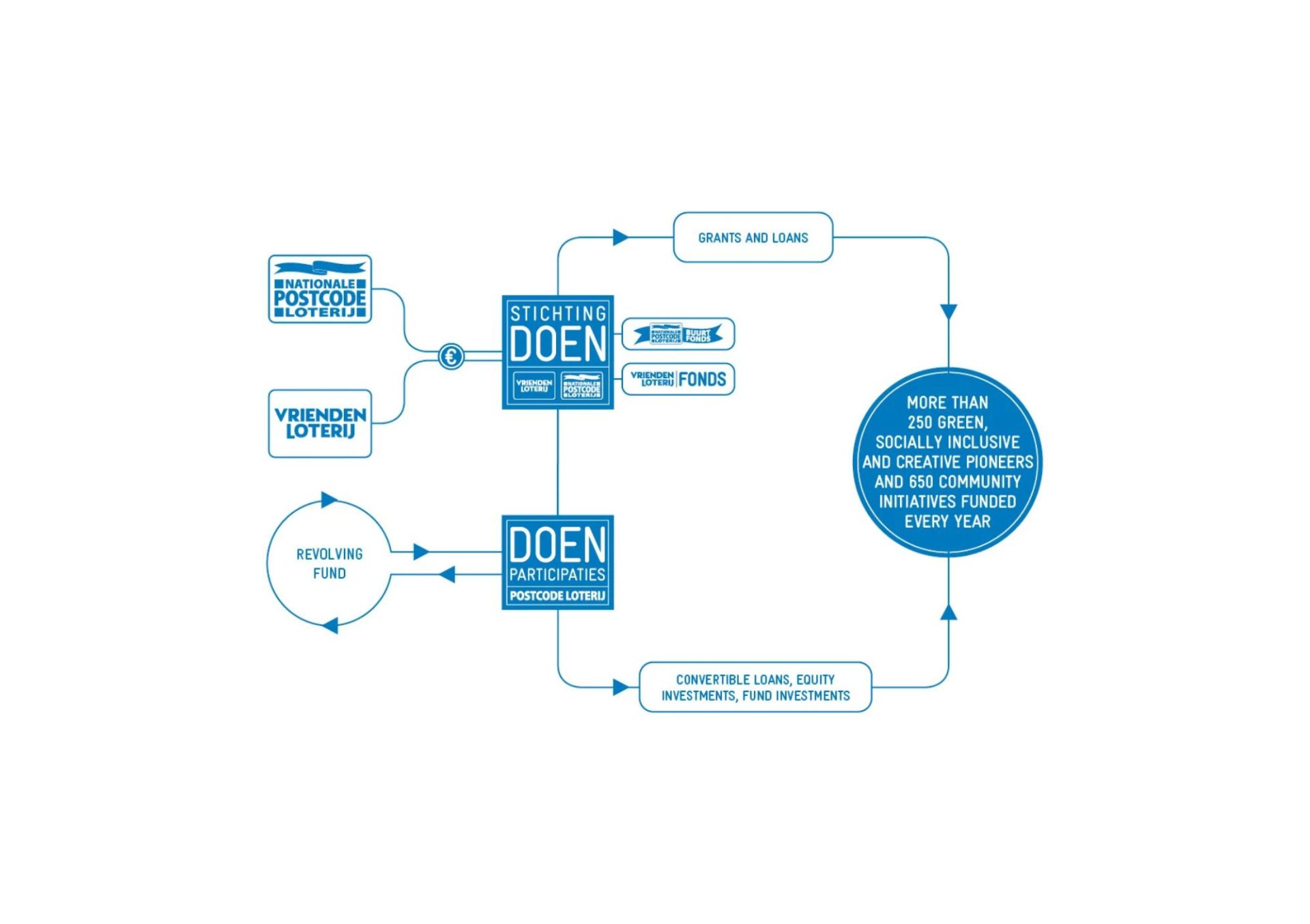

DOEN Ventures is fully owned and managed by the DOEN Foundation. The DOEN Foundation is the fund of the Postcode Loterij (Postcode Lottery) and the VriendenLoterij (FriendsLottery).

Why do we invest?

The DOEN Foundation operates in pursuit of objectives that are based on the principle of “invest where possible and subsidise where necessary”. Although the majority of the annual support consists of subsidy projects, the DOEN Foundation also provides loans. Through its investment company, DOEN Ventures BV, it invests in green and socially inclusive enterprises and funds that contribute to the objectives of the foundation: a green, socially inclusive and creative world.

DOEN Ventures does this by providing convertible loans, equity investments or guarantees, or by investing in funds. DOEN Ventures does not aim for financial profit, but primarily for social benefits. However, investing creates the possibility of re-using resources. Loans are repaid, shares are sold at a profit and/or a dividend is paid out. This is how the impact that DOEN Ventures has on society grows.

In the case of equity investments, at each stage there is an assessment of whether the sustainable or socially inclusive enterprise still contributes to the objectives of the DOEN Foundation. Monitoring consists of contractually documented reporting on progressions. DOEN Ventures will not seek an exit as long as a company contributes to the achievement of the objectives of the DOEN Foundation and as long as DOEN Ventures has a role to play within the enterprise. In other cases, DOEN Ventures will work towards an exit, but is patient. This strategy is very different from that of other investment companies, which generally adhere to a period of six years. In the case of an exit, DOEN Ventures values the continuation of the mission in selecting a potential buyer. In this way, contributing to a liveable world remains paramount even without the input of DOEN Ventures.

If you would like to know more, or want to submit an application please contact Katinka Ros, via [email protected].